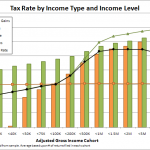

With the notable exception of IPOs and Private Equity purchases, most financial ‘investments’ in the stock market, FOREX market or derivatives market are not truly investing in a company or asset. Second hand transactions (after an IPO or initial offering) are glorified speculation, largely driven not by that asset’s underly performance, but by what other investors will pay for that asset. In this light, there is not much difference between buying a stock on the NYSE and putting money into a slot machine. Why then are most capital gains taxed at the 15% rate, while gambling earnings are taxed at the 25%+ rate?

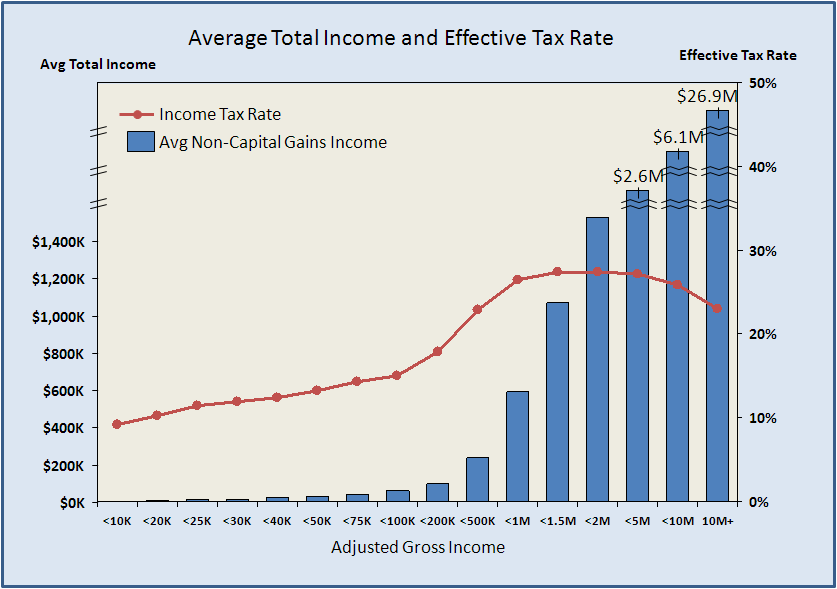

You can draw rhetoric about the ‘double taxation’ of corporations all you want, but the fact is that open market stock purchases have little to no impact on the performance of a corporation unless they issue new stock, which is a very rare occurrence. All of the benefit of stock price fluctuations goes to stockholders, who only face the capital gains tax. We’ve also seen in my earlier analyses on effective tax rates that capital gains are largely a game for the rich, with up to 80% of the upper cohort’s income arriving through this avenue. It’s not a stretch then to say that the only reason capital gains are taxed lower than gambling winnings is that the rich want it that way, and make their opinion known through campaign donations and lobbying efforts.